OYO, an Indian based hospitality company, with a string of franchised budget hotels in India, Malaysia, China and more recently Indonesia, has recently launched its entry into the competitive U.S. economy hotel market with a number of properties in Texas. It has also entered the U.K market with plans to operate ten properties by the end of 2019.

Launched in 2013, OYO is India’s largest hospitality company. Its network currently spans over 230 Indian cities including all major metros, regional commercial hubs, leisure destinations, and key pilgrimage towns. OYO revolutionized the fragmented and legacy-driven budget hospitality space in India by enabling standardization of services, amenities and in-room experience.

Through use of its proprietary apps for inventory-management, room-service, revenue-management and customer-relationship management, OYO has delivered predictable, affordable and available budget-room accommodation to millions of travelers in India.

Given the interest of OYO in the U.S. economy hotel sector, we thought we would take a brief bird’s eye view of this chain scale category.

According to STR, the lodging industry consisted of approximately 55,900 hotels representing approximately 5.3 million rooms open and operating in the United States at December 31, 2018. During the year ended December 31, 2018, the industry added approximately 115,000 gross rooms to the industry supply and net room growth was approximately 1.7%. About 77% of the new rooms opened during the year were positioned in the Upscale, Upper Midscale, Midscale and Economy chain scale segments.

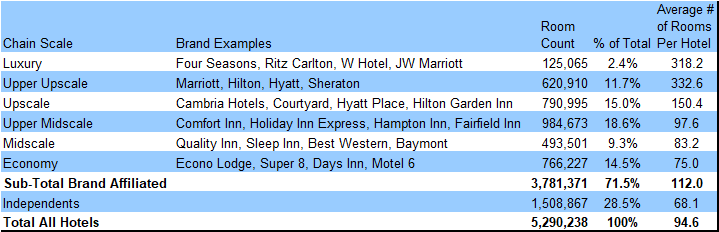

The Economy chain scale, which consists of brands such as Econo Lodge, Super 8, Days Inn and Motel 6, provided just over 766,000 rooms or 14.5% of the total room inventory in the U.S. in 2018 as illustrated in the table below.

The Size and Characteristics of U.S. Chain Scale Categories in 2018

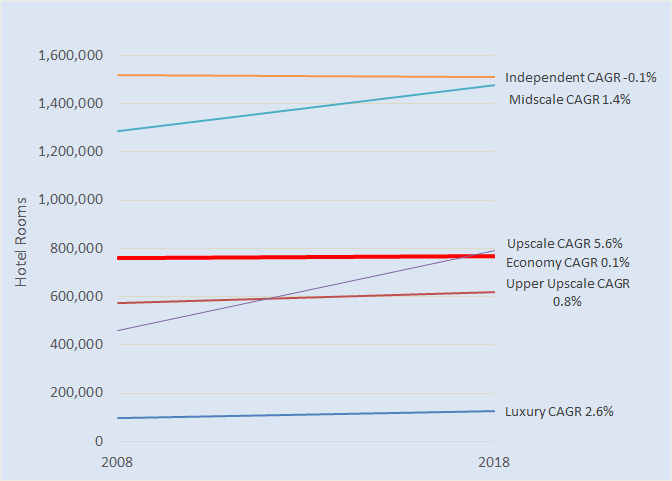

Over the past ten years, 2008-2018, the Economy sector has seen minimal growth in new room supply, growing at a CAGR of 0.1%, which compares with a CAGR of 1.2% for the lodging industry as a whole, 5.6% for the Upscale sector and 2.3% for the Luxury sector as illustrated in the graph below. Over the past five years, 2013-2018, the number of rooms in the Economy sector declined by a CAGR of -0.2%. Apart from Independents, all the other chain scale segments witnessed varying growth rates with Upscale leading the way with a CAGR of 5.2%, followed by Luxury at CAGR 3.2%.

According to STR, just over 200,000 rooms are currently under construction in the U.S. with the greatest number in the Upper Midscale (64,900 rooms) and Upscale (60,800 rooms) sectors. Only 2,900 economy rooms are currently under construction.

Growth in the Supply of Hotel Rooms for the Major U.S. Chain Scale Categories 2008-2018

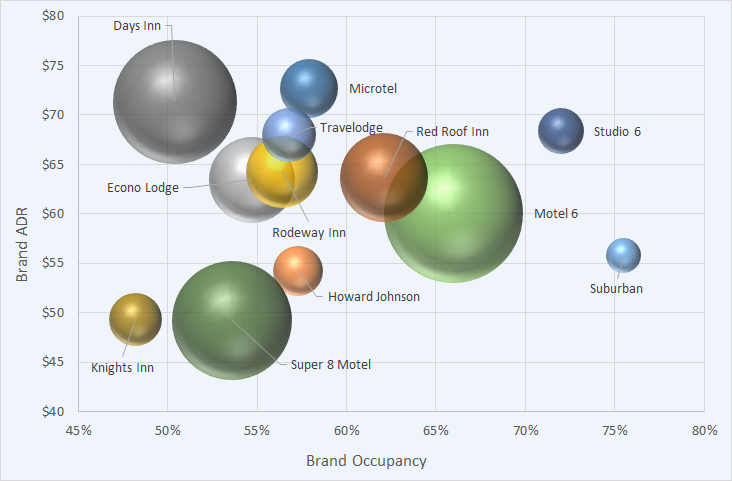

So where does OYO plan to position itself in the highly competitive Economy market? The sector is dominated by four major companies, Wyndham with 302,600 rooms or 39.5% of the total, Choice Hotels with 92,500 rooms (12.1%), G6 Hospitality with 122,500 rooms (16%) and Red Roof Inn, with 47,700 rooms (6.2%). Other groups have about 201,000 rooms or 26.2% of the total.

Three of the companies have multiple brands in the sector: Wyndham has Howard Johnson, Days Inn, Microtel Inn, Super 8 Motel and Travelodge; Choice has Econo Lodge, Rodeway Inn and Suburban and G6 Hospitality has Motel 6 and Studio 6. The dominant brands by market size include Days Inn, Motel 6 and Super 8 Motel as illustrated in the graph below.

The Location of the Major U.S. Economy Hotel Brands by Occupancy & ADR in 2018

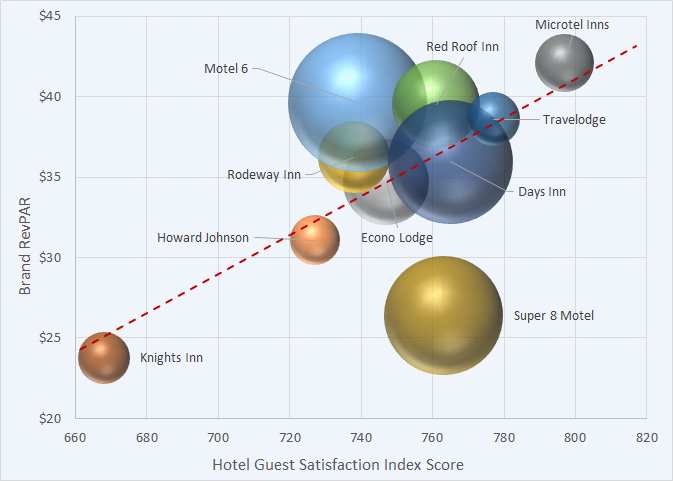

With the recent (7-24-2019) release of J.D. Powers latest North America Hotel Guest Satisfaction Index, it is possible to examine the relationship between guest satisfaction and the RevPAR achieved by the leading Economy brands as illustrated in the graph below. Microtel by Wyndham had the highest guest satisfaction ranking for Economy hotels at 797, followed by Travelodge by Wyndham 777 and Days Inn by Wyndham.

The Relationship Between the Hotel Guest Satisfaction Index Score and RevPAR for the Major U.S. Economy Hotel Brands

In light of the entrenched market players in this segment of the lodging industry, it will be interesting to see how OYO fairs in what has been a fairly stable corner of the lodging industry.