Hotels throughout Indonesia experienced a significant negative price momentum in the first quarter of 2020 due the impact of the Covid-19 pandemic according to the most recent Commercial Property Survey undertaken by Bank Indonesia.

On an annual basis ending 1Q 2020, the index for Indonesia fell by 12.1%. Across the country it ranged from a high of -16.9% in Semarang to a low of -2.1% for Banten as illustrated in the table below.

Annual & Quarterly Growth of the Hotel Property Price Index for Indonesia’s Major Hotel Markets 1Q 2020.

| City | % Annual Change | % Quarterly Change |

| Jakarta | -12.5% | -16.3% |

| Bobebek | -11.2% | -15.2% |

| Banten | -2.1% | -12.7% |

| Bandung | -10% | -15.6% |

| Makassar | -10.3% | -15% |

| Medan | -9.6% | -12.3% |

| Semarang | -16.9% | -22.6% |

| Surabaya | -10.2% | -15.1% |

| Balikpapan | -11.4% | -15.2% |

| Denpasar | -14.7% | -19.2% |

| Palembang | -4.1% | -3.5% |

| Indonesia | -12.1% | -16.5% |

Source: Commercial Property Survey Quarter 1 – 2020, Bank Indonesia

Despite the Indonesian Government’s initiative to provide IDR25 trillion stimulus package which includes hotel, airfare and food and beverage discounts to speed up the recovery of the tourism industry after the pandemic subsides, we believe the pandemic will continue to have a negative impact on the hotel index and the value of hotels in the second and third quarters of 2020 leading to a growing number of distressed hotels. The sector is likely to attract the interest of contrarian and cash-rich private equity and family groups, of which there are many in Asia with the experience in this operationally-intensive business.

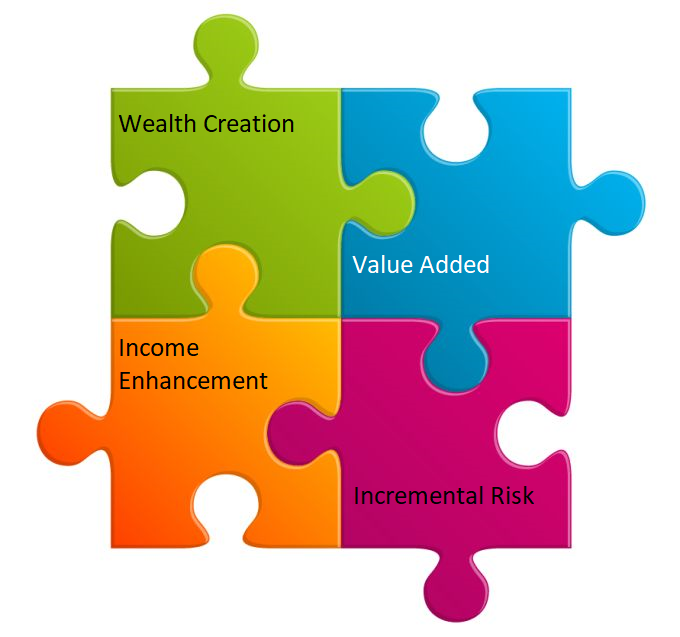

These investors are likely to deliver top-quartile results by deploying higher return strategies through wealth creation (development, redevelopment, repositioning), value added (superior investing skills – selection and timing – to exploit market inefficiencies), income enhancement (superior operating skills to enhance revenue and operate more efficiently) and incremental risk (investment/leverage combinations higher on return/volatility continuum). These investors understand that fortunes are made in downturns because fortunes are lost in downturns.