What are the best hotel markets?

We are frequently asked, “What are the best hotel markets?” To which we normally reply, “What do you mean by best?” For some it may mean the markets likely to deliver the highest capital appreciation over the next five years, and for others it may mean the markets likely to deliver the highest risk-adjusted returns. For others, it may mean markets ripe for development or markets providing the greatest opportunities for buying distressed hotels.

Implicit in each question is the notion of risk and return and the expectations of different investment strategies. As an investor, are you willing to accept additional risk to achieve higher returns or are you risk averse? Simply looking at markets that have the highest RevPAR growth rates may not be the “best” way of judging markets for a particular investment strategy or hotel portfolio.

The traditional deal-by-deal approach to hotel real estate investing is giving way to a more enlightened approach, whereby investors are achieving superior risk-adjusted returns by targeting and timing hotel real estate markets. The use of target markets enables investors to better use market intelligence, to become more disciplined in their acquisitions and dispositions, and to enhance the performance of their hotel portfolios. An overlooked but highly valuable byproduct from developing target markets is a list of markets to avoid. Our post focuses on targeting hotel markets and as usual we look forward to your comments.

Selecting the Best Hotel Product Types & Markets

With lodging industry fundamentals holding their own with investors in 2018, many investors are tweaking their existing investment strategies while others are carefully developing new strategies for a potential industry downturn across the country. But where are these opportunities and what lodging sectors are likely to lead the charge? Uncovering opportunity in today’s buoyant market is often difficult. Sometimes, hiding in plain sight, the tried-and tested can be overlooked. Out-of-favor strategies may be back in vogue with changing market conditions, both from a return-on-investment perspective as well as a development perspective.

Our experience has taught us that hotel investment opportunities are available at every phase of the hotel real estate cycle and that rigorous analysis of market fundamentals is essential to identifying hotel types, markets and assets with potential for above-market performance. After all, most investors seek positive “alpha”, the measure of a hotel investment’s return over the market’s return.

As the economy and capital markets deal with growing uncertainty, hotel values will begin to moderate. In anticipation of the coming slow-down, a hotel portfolio that is over-weighted in high-beta sectors and markets, is likely to under-perform the market over the next five years. Hotel investors with concerns about the direction and stability of the economy, are focusing on low-beta markets with the potential to deliver solid and stable returns in the top quartile.

With experience and foresight, investors now seek to identify hotel chain scales, location types, and markets that will deliver top quartile (top 25%) returns believing the use of target chain scales, location types, and markets will enhance the performance of their hotel portfolios.

Hotel Location Types

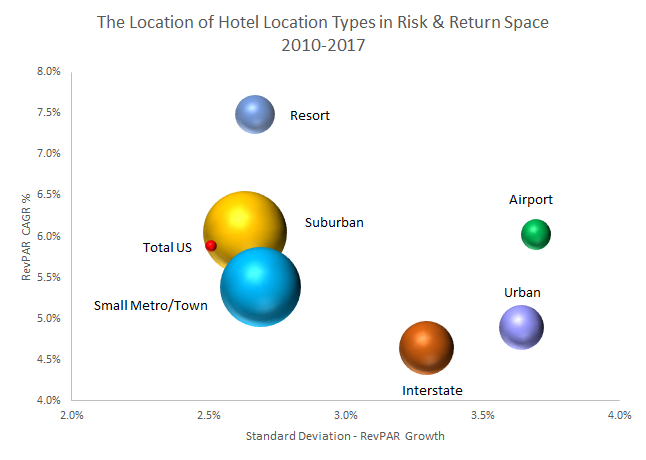

A useful starting point is an analysis of the historical performance of lodging segments since the Great Recession. It may come as a surprise to many that resorts have recorded the highest risk-adjusted RevPAR growth rates¹ over the period as illustrated in the accompanying table. Accounting for about 7% of hotels and 12% of hotel rooms in the U.S., resorts achieved a 7.5% RevPAR CAGR for 2010-2017 and the lowest standard deviation of annual RevPAR growth over the period. Judicious investments in this sector may be a valuable addition to a large-city-only portfolio, both as a return enhancer and a risk diversifier.

The top performing hotel location segments over the past eight years in terms of RevPAR growth, were the resort, suburban, and airport segments, which recorded RevPAR CAGRs of 7.5%, 6% and 6% respectively as illustrated in the accompanying graph. The airport segment however, was burdened by significant risk measured by the standard deviation of annual RevPAR growth.

Source: Hotel Investment Strategies, LLC based on an analysis of STR Global data.

Interstate and urban hotels were the real laggards over the past eight years with the poorest RevPAR growth rates and significant risk. The performance of interstate and suburban hotels varied widely at any point in time. These variations make thoughtful geographic diversification and market selection critical to investment performance in these sectors.

Chain Scale

Over the past decade the Upper Midscale and the Midscale segments have generated significant investor interest. The Midscale segment, which includes such brands as Ibis, La Quinta and Ramada has generated the third highest risk-adjusted RevPAR growth rates, and sits just below the Economy and Independent segments as illustrated below. The Upper Midscale segment, which is represented by such brands as Holiday Inn Express, Hampton Inn and Quality, has enjoyed the fourth highest average RevPAR growth rates.

While the luxury segment recorded the second highest growth rate, it experienced the highest risk, and clearly has a high beta compared to other chain scales. All the chain scales, apart from economy and independents recorded below average risk-adjusted RevPAR growth rates since 2010.

Target markets are markets where hotel investors aim to invest their money and seek superior returns. Such markets can be short term oriented and opportunistic, or long-term and diversification-driven. The selection can be based on relative hotel real estate value, growth prospects, and/or the need to diversify. Embedded in “targeting markets” is a belief in active management and a “top-down” portfolio strategy.

With a growing recognition that market conditions have become more important in determining the success of an individual hotel, investors understand that hotel performance varies widely among different markets at any point in time as demonstrated by our analysis of the Top 25 hotel markets in risk and return space since 2010.

A major and highly valuable by product of developing target markets is a list of markets to avoid! If investors are confident that certain markets will perform well, based on models and market intelligence, they should be equally confident that some markets will not do well. Because avoiding declining markets helps to enhance the performance of a hotel portfolio, it seems important for investors to develop a list of markets to avoid. Surprisingly, developing such a list doesn’t seem to be as important as developing target markets!

Finally, the availability of timely market intelligence, and the seemingly predictable nature of hotel real estate markets, also give investors more confidence to target markets. Over the past ten years, good statistics on markets have become readily available, giving investors ammunition for market forecasting, and identifying target markets from the hotel investable universe.

Buy-Hold-Sell Recommendations

In light of the historical performance of the chain scale segments in risk and return space, it is interesting to examine the hotel buy/hold/sell recommendations for 2019 of a large number of industry experts, including investors, fund managers, developers, property companies, lenders, brokers, advisers, and consultants.

PwC’s survey found that only 12.5% of respondents recorded a buy recommendation for luxury hotels in 2019 compared to 23.4% who recorded a buy recommendation for midscale hotels as illustrated below. The sentiment is amplified by the significant percentage of respondents who registered a sell recommendation for luxury hotels (42.3%) compared to 28.7% who registered a sell recommendation for midscale hotels.

Source: Emerging Trends in Real Estate 2019 survey.

The hotel buy/hold/sell recommendations for 2019 are clearly related to respondent’s opinions on the current hotel pricing for luxury, upscale, limited-service and midscale hotels as outlined below. Almost 55% of respondents indicated that luxury hotels were overpriced compared to only 20% who thought midscale hotels were overpriced. Now in order to identify hotels likely to deliver high risk-adjusted returns or positive “alpha”( most bang for the buck), investors need some idea about what hotel values and expected returns should be in equilibrium.

Without a theory and accompanying model of market equilibrium, it is doubtful whether investors can identify underpriced hotels, other than by chance. Intuition and DCF analysis alone, do not cut it when positive “alpha” is the goal. Despite the scarcity of equilibrium models in hotel asset pricing, investor sentiment plays an important part in hotel sales.

Source: Emerging Trends in Real Estate 2019 survey.

The following graph presents the recommendations to buy, hold or sell hotel property in the United States in 2019 in leading hotel real estate locations. According to 41% of the survey respondents, San Diego was a good place to purchase hotel property in 2019 compared to only 27% who indicated that San Francisco was a good place to buy a hotel in 2019.

Source: PwC; Urban Land Institute. 1,630 respondents; industry experts, including investors, fund managers, developers, property companies, lenders, brokers, advisers, and consultants. Cities listed are the top 20 rated for investment in the hotel sector.

If you would like more information on our approach to target hotel market screening and selection and how we have assisted top multiunit owners and developers with their hotel investment strategies, please contact us and request a complimentary copy of “Targeting Hotel Markets”. We look forward to hearing from you.

¹The risk-adjusted RevPAR growth rate is designed to determine whether a hotel chain scale/ location type or market’s RevPAR growth compensates for its volatility. A positive value indicates that RevPAR growth compensates for the volatility in the hotel chain scale /location type or market’s RevPAR growth. Although metros may have similar RevPAR growth rates, the volatility of their respective RevPAR growth rates may be different, which leads to different risk-adjusted RevPAR growth rates.