With tourist arrivals almost doubling over the past five years, growing from 8.8 million in 2013 to 15.8 million in 2018, Indonesia’s star-rated hotel supply has experienced a dramatic expansion over the same period.

Driven by the growth in inbound visitor arrivals and strengthening macro-economic fundaments, an expanding middle class, and rising consumer spending, the star-rated hotel sector is set to see a healthy 12% CAGR in room supply over the period 2019-2023.

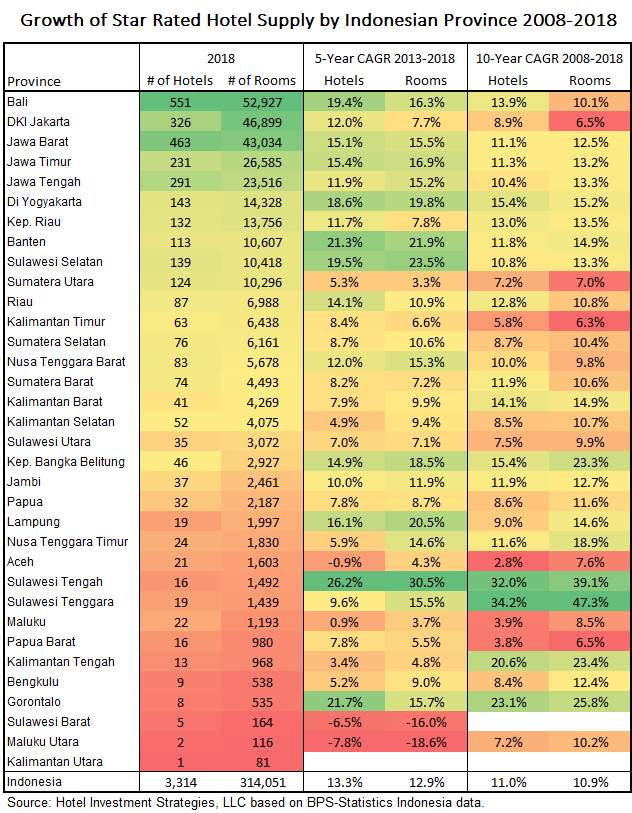

With inbound international visitor arrivals growing at CAGR 12.4% between 2013 and 2018, the supply of star-rated hotel rooms mirrored this growth at CAGR 12.9% as illustrated in the table below. Over the past ten years, 2008-2018, the supply of star-rated hotel rooms grew at CAGR 10.9%, ranging from a high of 47.3% for the Province of Sulawesi Tengah to a low of 6.3% for the Province of Kalimantan Timur.

The Top 5 provinces for the supply of star-rated hotels (Bali, DKI Jakarta, Jawa Barat, Jawa Timur and Jawa Tengah) account for about 61% of all star-rated accommodation in Indonesia. Apart from DKI Jakarta, the Top 5 provinces experienced double-digit supply growth rates, ranging from a CAGR of 15.2% for Jawa Tengah to 16.9% for Jawa Timur.

While the supply of star-rated hotels has grown rapidly over the past five years, the demand for this type of accommodation has grown more quickly, growing at CAGR 24.7% for the period 2012-2017. Indonesia’s star-rated hotels across the 34 provinces hosted 93.4 million room nights in 2017, up 16% from 80.4 million in 2016. Over the past five years (2012-2017) the demand for star-rated hotels (room nights occupied) has grown at a robust CAGR of 24.7%, compared to 17.4% over the ten-year period 2007-2017. See our accompanying blog: The Growth Of Star Rated Hotel Room Demand By Indonesian Province & Star Rating 2012-2017.

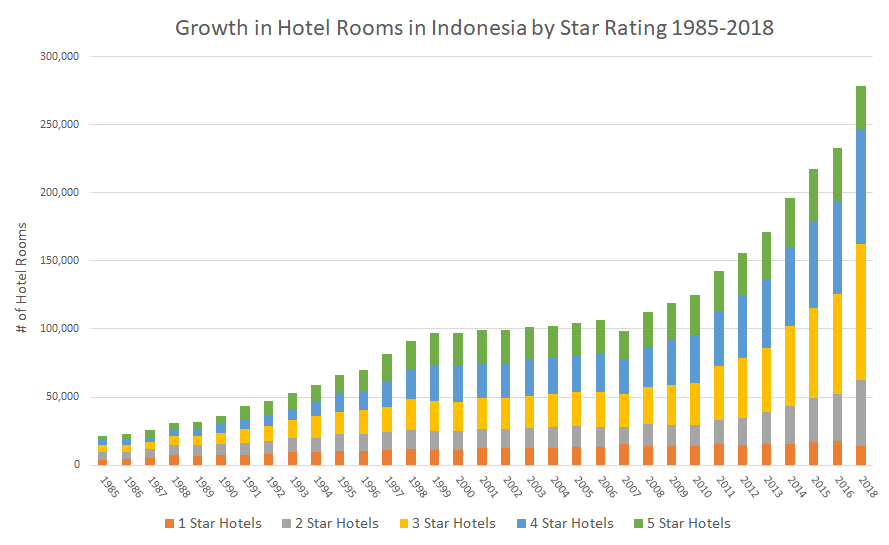

The significant upsurge in the growth of star-rated hotel rooms began in 2008 as illustrated in the graph below. Since 2008, the 3-star category led the way in new supply with a CAGR of 13.8%, followed by the 2-star category with a CAGR of 11.6% and the 4-star category with a CAGR of 11.3%. The supply of 5-star hotel rooms has only grown at CAGR 2.1% from 2008.

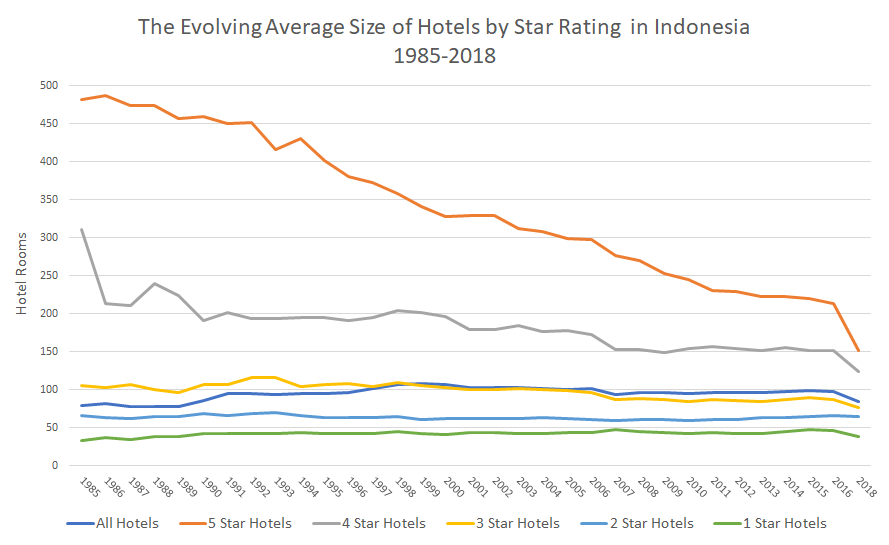

An interesting trend relates to the declining average size of 4 and 5-star hotels in Indonesia as illustrated in the graph below. The average 5-star hotel has declined in size from about 480 rooms in the mid 1980s to about 200 rooms in recent years. Similarly, the average 4-star hotel has declined from about 240 rooms to 140 rooms over the same period, with ramifications for the fixed and variable cost structures of these properties.

According to a recent report from analysts at Lodging Econometrics, Indonesia is among the top countries for hotel construction. The reports identifies 387 projects with 65,405 rooms in Indonesia, with the largest construction pipelines led by Jakarta, with 99 projects/18,820 rooms.